Remember when laptop and cellphone batteries would catch fire? I think it was back in the mid/late aughts. And we never bought those devices again. I certainly don't keep one of those little combustion units in my pocket all day next to an area with a lot of nerve endings. I'm so bored when I go to the restroom and can't look at the HBT meme threads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Poll: Do you have, or plan to get, an electric car?

- Thread starter Oldpaddy

- Start date

Help Support Homebrew Talk:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Status

- Not open for further replies.

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

I tend to buy GM and I don't hear that one much. Like, maybe I could count the number of times on one hand. I guess I just don't hang out with that crowd or visit use the right Google or YouTube search terms.

I have noticed plenty of Tesla superfans with YouTube channels suggest, on a couple occasions, that Tesla has beat/destroyed/checkmated traditional auto companies.

The auto industry has clearly demonstrated that it can support several auto companies. The transition to EVs is going to be pretty disruptive, but I don't see a reason why Tesla, GM, Ford, and Stellantis-Chrystler can't all still exist in 15 years as established, major companies.

If I was forced to put money on one of those companies not being around in 15 years, I'd say Chrysler. They're making weird decisions in the EV transition. I don't hope for them to fail, they're just dragging their heels.

I'm really curious how Rivian will navigate their first few years. I think they had a bad recall last year, but their marketing team has given them sort of a Jeep feel without the inefficiency (not that I know their vehicles mi/kWh).

Agree on the future of Stellantis (Chrysler). Maybe they and Rivian could someday end up in a ‘survivor’s merger’ like Jeep finding a niche after Willys in the 50s, and later the collapse of Rambler/American Motors. How about a Ram/Rivian mashup of EV consumer passenger trucks? The could give the F-150 a run for their money.

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

Ha, ha. I see what you did there!Remember when laptop and cellphone batteries would catch fire? I think it was back in the mid/late aughts. And we never bought those devices again. I certainly don't keep one of those little combustion units in my pocket all day next to an area with a lot of nerve endings. I'm so bored when I go to the restroom and can't look at the HBT meme threads.

My favorite is: Ford and GM are going to destroy Tesla.

Always makes me chuckle.

Tesla is in a weird place. They have a very limited vehicle lineup, and IMHO they don't really have a technology "moat" that can protect their first-mover advantage. They've missed the mark on FSD as it doesn't appear they're any closer to L5 capability than anyone else in the market. They're trying to expand their lineup with trucks, but also IMHO they've made a tremendous error with the Cybertruck that is not ultimately going to succeed. They're still a company with huge promises that go unfulfilled, and the ones they do fulfill are usually several years late.

The biggest issue is that I think they're still beholden to Panasonic for the critical tech (batteries). They may be ahead in battery production with their own gigafactories, but as far as I can tell, they're still just basically licensing the ability to build the batteries based on Panasonic's technology. A true battery technology advantage (and being vertically integrated in batteries) would be a significant advantage.

What they do have going for them is the fanboy gap. Tesla fans seem to me to be like Apple fans, where they think if you don't own a Tesla, you frankly don't own a "real" EV. Just as Apple fans think that if you own Android, you can DIAF. That's an emotional factor with Tesla that I'm not sure I can quantify in an economic sense.

But in the end, I think the truth is that building an EV isn't all that hard. There's a learning curve which Tesla scaled first, but now you have legacy automakers who are well-capitalized and already successful simply riding the learning curve of a new powertrain. Tesla essentially had no competition up until about 2-3 years ago, and very little until now, and now they're going to have to see if they can continue to scale up when they're no longer the only game in town.

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

Yeah, I’ve already priced it out with an electrician I’ve worked with before. Lookin’ at $2K, then at least another $500 for the charger. Includes a sub-box to the main panel, plus the high gauge Romex. That wiring ain’t cheap.I briefly considered adding a lelev 2 charger. The layout of the house/garage makes it pretty convenient to route the cable from the panel.

But I realized that there's functionally no difference to us between a 12 hour charge and 2.5 hour charge; it's just going to sit there overnight. So the charger would be more for "cool" factor than anything practical.

Add to that that the transformer feeding the house is tiny (10kVA? 15?). I'd likely need to open a permit and upgrade the service.

OTOH, having charging capability would likely help house price if selling. IMO people should be running 100A feeders* to garages, though, as the day of 60A charging circuits may end soonder than you think. The price difference between a #6 and a #3 installed is probably worth paying.

*I mean size the wires for future 100A.

Of course, this won't really matter until someone else starts fulfilling their own promises on time and I have no idea whether that will happen before Tesla does.They're still a company with huge promises that go unfulfilled, and the ones they do fulfill are usually several years late.

$53.24

1pc Hose Barb/MFL 1.5" Tri Clamp to Ball Lock Post Liquid Gas Homebrew Kegging Fermentation Parts Brewer Hardware SUS304(Gas MFL)

Guangshui Weilu You Trading Co., Ltd

$58.16

HUIZHUGS Brewing Equipment Keg Ball Lock Faucet 30cm Reinforced Silicone Hose Secondary Fermentation Homebrew Kegging Brewing Equipment

xiangshuizhenzhanglingfengshop

$7.79 ($7.79 / Count)

Craft A Brew - LalBrew Voss™ - Kveik Ale Yeast - For Craft Lagers - Ingredients for Home Brewing - Beer Making Supplies - (1 Pack)

Craft a Brew

$28.98

Five Star - 6022b_ - Star San - 32 Ounce - High Foaming Sanitizer

Great Fermentations of Indiana

$53.24

1pc Hose Barb/MFL 1.5" Tri Clamp to Ball Lock Post Liquid Gas Homebrew Kegging Fermentation Parts Brewer Hardware SUS304(Gas MFL)

yunchengshiyanhuqucuichendianzishangwuyouxiangongsi

$20.94

$29.99

The Brew Your Own Big Book of Clone Recipes: Featuring 300 Homebrew Recipes from Your Favorite Breweries

Amazon.com

$22.00 ($623.23 / Ounce)

AMZLMPKNTW Ball Lock Sample Faucet 30cm Reinforced Silicone Hose Secondary Fermentation Homebrew Kegging joyful

无为中南商贸有限公司

$33.99 ($17.00 / Count)

$41.99 ($21.00 / Count)

2 Pack 1 Gallon Large Fermentation Jars with 3 Airlocks and 2 SCREW Lids(100% Airtight Heavy Duty Lid w Silicone) - Wide Mouth Glass Jars w Scale Mark - Pickle Jars for Sauerkraut, Sourdough Starter

Qianfenie Direct

$172.35

2 Inch Tri Clamp Keg Manifold With Ball Lock Posts, Pressure Gauge, PRV (0-30 PSI) – Homebrew, Fermentation, Kegging System

wuhanshijiayangzhiyimaoyiyouxiangongsi

$10.99 ($31.16 / Ounce)

Hornindal Kveik Yeast for Homebrewing - Mead, Cider, Wine, Beer - 10g Packet - Saccharomyces Cerevisiae - Sold by Shadowhive.com

Shadowhive

$176.97

1pc Commercial Keg Manifold 2" Tri Clamp,Ball Lock Tapping Head,Pressure Gauge/Adjustable PRV for Kegging,Fermentation Control

hanhanbaihuoxiaoshoudian

$479.00

$559.00

EdgeStar KC1000SS Craft Brew Kegerator for 1/6 Barrel and Cornelius Kegs

Amazon.com

![Craft A Brew - Safale S-04 Dry Yeast - Fermentis - English Ale Dry Yeast - For English and American Ales and Hard Apple Ciders - Ingredients for Home Brewing - Beer Making Supplies - [1 Pack]](https://m.media-amazon.com/images/I/41fVGNh6JfL._SL500_.jpg)

$6.95 ($17.38 / Ounce)

$7.47 ($18.68 / Ounce)

Craft A Brew - Safale S-04 Dry Yeast - Fermentis - English Ale Dry Yeast - For English and American Ales and Hard Apple Ciders - Ingredients for Home Brewing - Beer Making Supplies - [1 Pack]

Hobby Homebrew

$39.22 ($39.22 / Count)

Brewer's Best Home Brew Beer Ingredient Kit - 5 Gallon (Mexican Cerveza)

Amazon.com

Of course, this won't really matter until someone else starts fulfilling their own promises on time and I have no idea whether that will happen before Tesla does.

Well, Chevy certainly beat Tesla to a sub-$30K EV in the Bolt. Ford (and Rivian) beat them to the truck game with the F150 Lightning and the R1. Hyundai/Kia are well-established now in the EV game with reputable products. On the luxury end, I really like the look of the Audi eTron and the eTron GT is a stunning little car. Mercedes is in the game. VW, from everything I can tell, is producing some very nice EVs.

It's now a crowded market, and to be frank, every one of those companies is still working their way through the EV learning curve to learn things Tesla has probably already seen and dealt with.

But give it 3 years, and Tesla becomes "just another automaker selling EVs" IMHO. Whether they can continue to succeed at that scale with a limited product offering is what remains to be seen. And if the other automakers leapfrog Tesla with the quality/features/styling/etc of the cars, or the price of the cars, then Tesla finds itself in a dangerous place.

Full disclosure: I don't like Elon Musk and I have my skepticism about Tesla as a company that probably biases my analysis. As I've said before I am bullish on EVs and there's a good chance my next vehicle purchase will be an EV, but it will NOT be a Tesla.

Bilsch

Well-Known Member

- Joined

- May 4, 2015

- Messages

- 1,754

- Reaction score

- 1,609

how to fight an EV fire?

FIREFIGHTING FOAM

CLASS D EXTINGUISHER

PANCAKE NOZZLE

FIRE BLANKET

PIERCING NOZZLE

LET IT BURN

NHTSA and NFPA data.

Hybrid-powered cars were involved in about 3,475 fires per every 100,000 sold. Gasoline-powered cars, about 1,530. Electric vehicles (EVs) saw just 25 fires per 100,000 sold.

Simple math says for every one EV fire there are 61 gas vehicle fires.

So the question is:

Would you rather have 139 hybrid fires or 61 ICE fires or one EV fire?

Bilsch

Well-Known Member

- Joined

- May 4, 2015

- Messages

- 1,754

- Reaction score

- 1,609

But give it 3 years, and Tesla becomes "just another automaker selling EVs" IMHO. Whether they can continue to succeed at that scale with a limited product offering is what remains to be seen. And if the other automakers leapfrog Tesla with the quality/features/styling/etc of the cars, or the price of the cars, then Tesla finds itself in a dangerous place.

Can’t see that happening especially since the other manufacturers (except the Chinese) are selling their EV at a loss.

Fascinating

You can’t knock Tesla “fanboy-ism” without at least admitting that the charging situation that comes along with owning one is VASTLY superior to all else.Tesla is in a weird place. They have a very limited vehicle lineup, and IMHO they don't really have a technology "moat" that can protect their first-mover advantage. They've missed the mark on FSD as it doesn't appear they're any closer to L5 capability than anyone else in the market. They're trying to expand their lineup with trucks, but also IMHO they've made a tremendous error with the Cybertruck that is not ultimately going to succeed. They're still a company with huge promises that go unfulfilled, and the ones they do fulfill are usually several years late.

The biggest issue is that I think they're still beholden to Panasonic for the critical tech (batteries). They may be ahead in battery production with their own gigafactories, but as far as I can tell, they're still just basically licensing the ability to build the batteries based on Panasonic's technology. A true battery technology advantage (and being vertically integrated in batteries) would be a significant advantage.

What they do have going for them is the fanboy gap. Tesla fans seem to me to be like Apple fans, where they think if you don't own a Tesla, you frankly don't own a "real" EV. Just as Apple fans think that if you own Android, you can DIAF. That's an emotional factor with Tesla that I'm not sure I can quantify in an economic sense.

But in the end, I think the truth is that building an EV isn't all that hard. There's a learning curve which Tesla scaled first, but now you have legacy automakers who are well-capitalized and already successful simply riding the learning curve of a new powertrain. Tesla essentially had no competition up until about 2-3 years ago, and very little until now, and now they're going to have to see if they can continue to scale up when they're no longer the only game in town.

My Tesla roadtrips are nearly identical to my gas road trips. Try that in any other EV.

I look forward to a supercharger to CCS adaptor being available so I have the option of using a supercharger. I will be surprised if one doesn't become available this year, now that NACS is being adopted by other automakers.

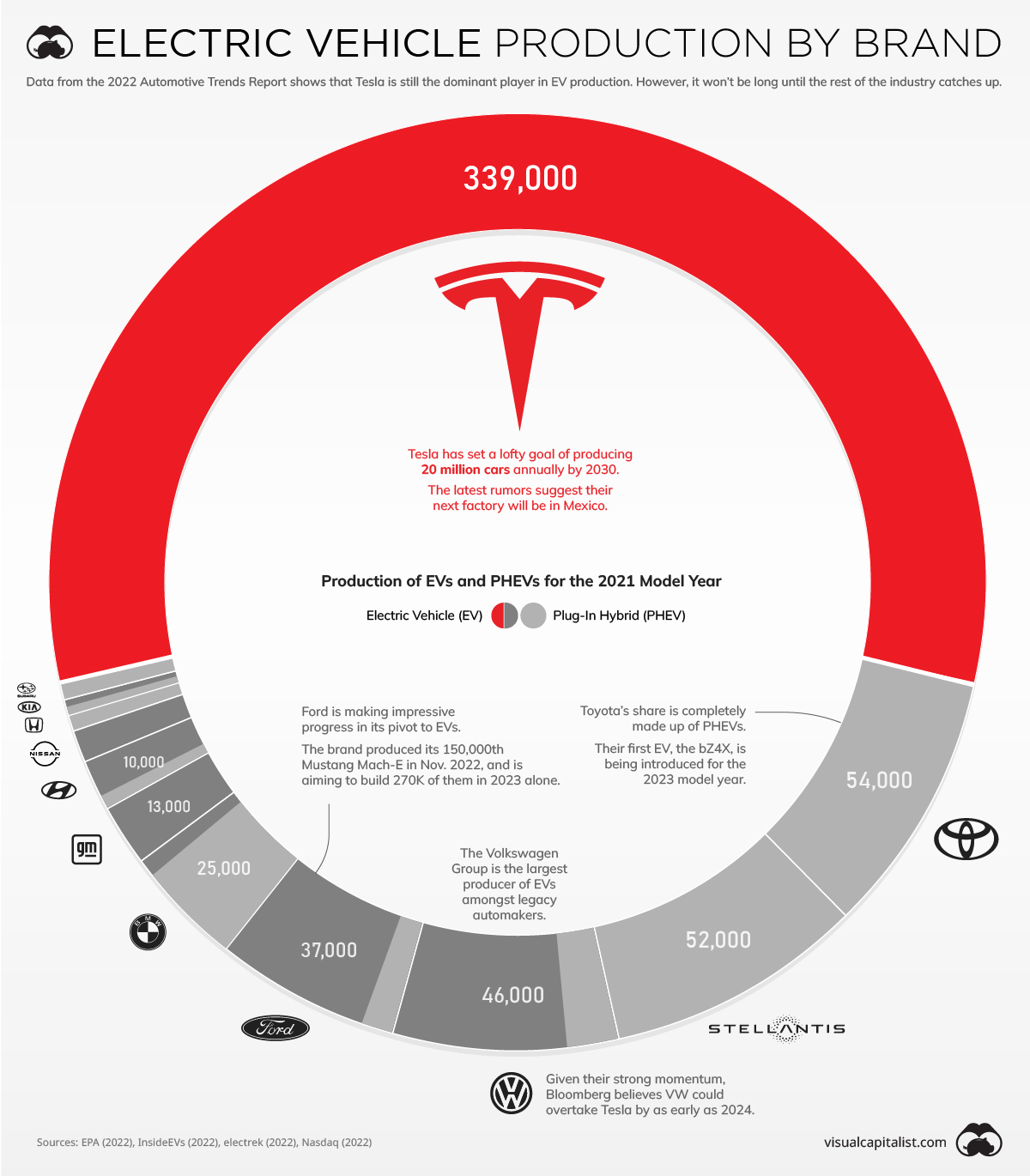

First, you're showing data from 2021. The non-Tesla EV market has changed significantly between 2021 and 2023.Can’t see that happening especially since the other manufacturers (except the Chinese) are selling their EV at a loss.

View attachment 838164

Second, the "selling at a loss" thing is a trope. Their EV divisions are losing money because (like Tesla) they had to stand up new product divisions, do R&D, do engineering, do manufacturing and reliability testing, create marketing orgs, ramp up production facilities and new supply chain partners, all before they produced and sold a single vehicle. That cost has to be amortized against the entire volume they produce and sell, which hasn't hit the tipping point to make the EV divisions profitable.

That doesn't mean they have negative gross margin on each vehicle, which is what is implied when most people say they're selling their EVs at a loss.

You can’t knock Tesla “fanboy-ism” without at least admitting that the charging situation that comes along with owning one is VASTLY superior to all else.

My Tesla roadtrips are nearly identical to my gas road trips. Try that in any other EV.

Yes, Tesla made the EV market and it wouldn't probably have been successful if they didn't build out their own charging network. It's a "chicken and egg" scenario--nobody is going to build chargers if nobody buys EVs, and nobody will buy EVs if there isn't a charging network.

However, I'd argue that the charging network is more about EV perception than EV reality, for the EXACT reason you constantly point out as the benefit of owning an EV. EV ownership makes the most sense if you can charge at home, and so the goal is to use public charging options as infrequently as possible.

Tesla opening up their charging network to other brands, however, is a game changer both for other brands by giving them access to a widespread charging network, and is a potential accretive revenue stream for Tesla that they're not accessing today b/c they obviously earn a profit on every kWh delivered. And it can help their overall charger utilization numbers by increasing demand, increasing profit per Supercharger.

Unfortunately EV perception is a major factor to overcome, and reliable charging networks help on that front.

It’s very tough to explain to most people that their driving habits fit an ev. Many for various reasons simply can’t or refuse to even consider how their daily needs trump the outliers they tend to focus on. So improvements in charge time and availability will be necessary (even if they truly aren’t) to get this type of holdout to consider making the switch.

It’s very tough to explain to most people that their driving habits fit an ev. Many for various reasons simply can’t or refuse to even consider how their daily needs trump the outliers they tend to focus on. So improvements in charge time and availability will be necessary (even if they truly aren’t) to get this type of holdout to consider making the switch.

Bilsch

Well-Known Member

- Joined

- May 4, 2015

- Messages

- 1,754

- Reaction score

- 1,609

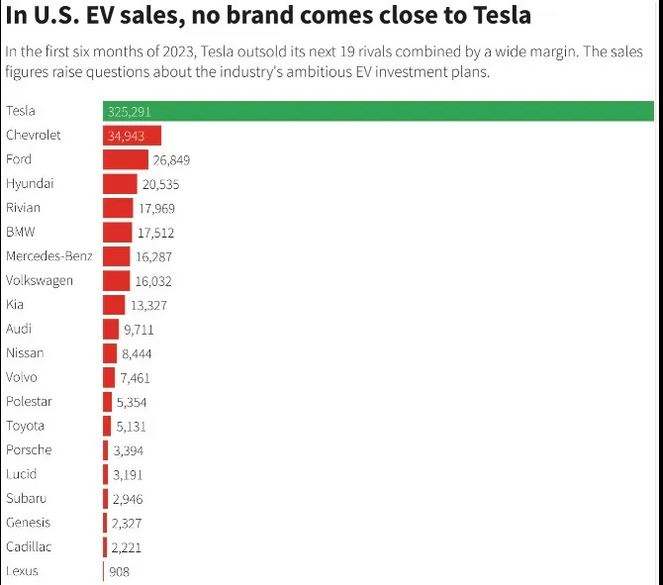

How about this one for the first half of 2023. Does this give you more hope for the legacy manufacturers surviving?First, you're showing data from 2021. The non-Tesla EV market has changed significantly between 2021 and 2023.

Thank you. That's significantly more useful data. I specifically appreciate that they didn't include PHEVs which to an extent muddied the usefulness previous infographic you provided. I.e. with this it basically removes Toyota from the equation as they're just barely introducing the bz4x. I'm actually really surprised the Ford numbers are so low. I would have thought the Mustang Mach E and now the F-150 Lightning would have put them well over 20K in the first half of the year...How about this one for the first half of 2023. Does this give you more hope for the legacy manufacturers surviving?

View attachment 838186

That said, per your second question, I'm not at all concerned about the legacy automakers "surviving". Annually there's somewhere in the realm of >15M new car sales in the US. I haven't seen the final data, but I know EVs passed 1M units already and at least some google results are saying it might be as much as 9% of the total in 2023, so maybe in the 1.3-1.4M range.

GM sold 2.6M vehicles in the US in 2023. Ford sold just shy of 2M vehicles in the US in 2023. Toyota sold 2.3M.

Every one of those automakers is a secure and stable brand, well-capitalized, with a full portfolio of vehicles, and is now working through a transition in the development and productization of EV platforms. I don't think they're worried about survival because they today only have a small part of 9% of the market. Statista says 2028 will only see growth to 2.4M BEV sales in the US, so it's not like they're "late". I'd say they're all entering the market at pretty much the right time.

So no, I'm not worried about the legacy automakers surviving.

Does this give you more hope for the legacy manufacturers surviving?

I don't understand that phrasing. It isn't that I love all the legacy automakers and dislike Tesla. As disruptive as a transition to EVs is, I just don't see all the legacy automakers going belly up over it. Tesla seems to be targeting a certain demographic, they aren't interested in selling to people who can't afford a new $35k+ vehicle. Does Tesla offer a vehicle with a third row? I genuinely don't know. I don't think we want Tesla in it's current form to have a monopoly on making cars.

They have been doing a fantastic job making luxury vehicles that appeal to people who wouldn't normally consider an EV. And yes, their charging station division has made a fantastic network.

Also fascinating.

Does Tesla offer a vehicle with a third row? I genuinely don't know.

Both X and Y offer third row.

Not sure that the second row or the third row is ANYWHERE near as roomy in comparison to my Ford Flex though... At 6'5" I've ridden quite comfortably in the second row of a Ford Flex and I don't say that about the back seat / 2nd row of many vehicles. Apparently the third row is maybe not comfortable for someone of my stature, but it's also not relegated to only small children.

I suspect the Tesla X/Y are like most 3rd row vehicles; it's an afterthought put there that you buy on the RARE case you need to use it, but it won't regularly be occupied in daily life.

When I bought the Flex, the Y wasn't available yet, and the X was far outside my price range. But even today, I think it'd be a hard sell to compare the Y for a family of my size (my giant carcass, my wife, 3 kids including the oldest who is 6'1", and a 97# golden retriever) with a more modern equivalent of the now-discontinued Flex, the 2024 Hyundai Santa Fe or Dodge Durango. Or a real crowd-mover like the Honda Odyssey minivan.

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

It was about 5 years ago, but we spent the better part of a week riding between SoCal vineyards and wineries with my wife’s cousin, his wife and adult daughter in their Model X. None of us are giants, but the seating was quite roomy and comfortable.

The vertically opening doors were really impressive for we of the older set, as was the auto-drive mode merge onto the 805 near Orange County/John Wayne airport. Did I mention Ludicrous Mode?

The vertically opening doors were really impressive for we of the older set, as was the auto-drive mode merge onto the 805 near Orange County/John Wayne airport. Did I mention Ludicrous Mode?

Both X and Y offer third row.

I learned something new today.

Bilsch

Well-Known Member

- Joined

- May 4, 2015

- Messages

- 1,754

- Reaction score

- 1,609

I don't understand that phrasing. It isn't that I love all the legacy automakers and dislike Tesla. As disruptive as a transition to EVs is, I just don't see all the legacy automakers going belly up over it. Tesla seems to be targeting a certain demographic, they aren't interested in selling to people who can't afford a new $35k+ vehicle. Does Tesla offer a vehicle with a third row? I genuinely don't know. I don't think we want Tesla in it's current form to have a monopoly on making cars.

They have been doing a fantastic job making luxury vehicles that appeal to people who wouldn't normally consider an EV. And yes, their charging station division has made a fantastic network.

I think our original question in this line was will legacy survive and not will Tesla be the one to put then under. It's obvious to even this Tesla fanboy that the Chinese will be legacy's undoing. Tesla simply proved that EV were practical, were the future and that people would buy them. When a decent new import vehicle is $10 or $15k instead of $30k, that is when you'll know disruption is already over. The wave is already happening as witnessed by BYD's recent numbers. GM and Ford meanwhile are slowing EV production, raising prices and delaying new models. To me it's not hard to see the writing on the wall.

Last edited:

Ah, I think I understand your point of view a little better now.

If so, I hope you love it. It could be my next car too, though not for a while.I want this car yesterday

I have a couple of concerns about the EX30. I've become spoiled by heated seats and steering wheel - didn't find those on the web site. Also, it looks like the touch screen does almost everything, but some functions deserve hard buttons to help keep the driver's eyes on the road. I hope the designers put those on the steering wheel.

Otherwise, it has what I need. And it's a

It was about 5 years ago, but we spent the better part of a week riding between SoCal vineyards and wineries with my wife’s cousin, his wife and adult daughter in their Model X. None of us are giants, but the seating was quite roomy and comfortable.

The vertically opening doors were really impressive for we of the older set, as was the auto-drive mode merge onto the 805 near Orange County/John Wayne airport. Did I mention Ludicrous Mode?

I'd hope it's nice, starting at almost $70K lol... But just about everyone who's ever ridden in my Ford Flex comments on how nice it is. It's like a La-Z-Boy on wheels. We had a day driving around Paso Robles wineries with myself, my 6'3" brother, my wife, his wife, my 70 yo MIL, and my 70 yo stepdad-in-law (with replaced knees) and everyone was pretty comfortable--including those in the third row.

Granted, after a few winery stops, people were a little inclined to feel comfortable

That said I know the merge onto the 405 South from SNA quite well... I'm not sure I'd trust that move to FSD...

I think our original question in this line was will legacy survive and not will Tesla be the one to put then under. It's obvious to even this Tesla fanboy that the Chinese will be legacy's undoing. Tesla simply proved that EV were practical, were the future and that people would buy them. When a decent new import vehicle is $10 or $15k instead of $30k, that is when you'll know disruption is already over. The wave is already happening as witnessed by BYD's recent numbers. GM and Ford meanwhile are slowing EV production, raising prices and delaying new models. To me it's not hard to see the writing on the wall.

Like Kent, I get your point a little better now... I didn't gather the China angle from the previous infographics you posted.

Ultimately, though, EV pricing will be driven by battery costs. Which is driven by battery technology.

The biggest risk to legacy automakers, that I said before while highlighting that Tesla is not this, IMHO is a company that is an automotive company and is simultaneously vertically integrated in battery technology and production. I could definitely see the Chinese doing that.

As I've said many times, I come from the data storage industry. Ultimately, it's impossible to be successful large scale in SSDs if you're not vertically integrated as a NAND supplier. Which is basically 4 companies or 5 companies, depending on how you score one particular joint venture fabrication company. The Chinese are trying to horn in on that via a new NAND fab company called YMTC, but they haven't yet proven that they can sell outside their own borders to any real degree.

I view the BEV industry the same way. It's going to come down to who can actually be or buy a leading battery technology firm. Ultimately today's ICEV manufacturers are all engine experts--for BEVs it's going to be batteries.

Not almost. Mos' def'.almost definitely

The S used to offer a 3rd row also. Jump seats, but still. I don’t know if the new ones still have that as an option.

As for superchargers

I take this to mean that they're on the horizon.

https://a2zevshop.com/products/nacs-ccs1

Preorders available for a NACS/Supercharger to CCS adaptor with a 1-year warranty.

1 year sounds a little low to me. I bought my EV anticipating I wouldn't be using a supercharger any time soon. I'm going to wait and see how these adapters are reviewed.

Last edited:

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

Rented a Ford Flex for a week shortly after they came out. I was very impressed, and actually considered buying one. LOTS of interior space, and handled highway and urban traffic very well. I’ve owned nearly as many Fords as Volvos, including 2 Ford pickups. All solid performers.I'd hope it's nice, starting at almost $70K lol... But just about everyone who's ever ridden in my Ford Flex comments on how nice it is. It's like a La-Z-Boy on wheels. We had a day driving around Paso Robles wineries with myself, my 6'3" brother, my wife, his wife, my 70 yo MIL, and my 70 yo stepdad-in-law (with replaced knees) and everyone was pretty comfortable--including those in the third row.

Granted, after a few winery stops, people were a little inclined to feel comfortable

That said I know the merge onto the 405 South from SNA quite well... I'm not sure I'd trust that move to FSD...

Like Kent, I get your point a little better now... I didn't gather the China angle from the previous infographics you posted.

Ultimately, though, EV pricing will be driven by battery costs. Which is driven by battery technology.

The biggest risk to legacy automakers, that I said before while highlighting that Tesla is not this, IMHO is a company that is an automotive company and is simultaneously vertically integrated in battery technology and production. I could definitely see the Chinese doing that.

As I've said many times, I come from the data storage industry. Ultimately, it's impossible to be successful large scale in SSDs if you're not vertically integrated as a NAND supplier. Which is basically 4 companies or 5 companies, depending on how you score one particular joint venture fabrication company. The Chinese are trying to horn in on that via a new NAND fab company called YMTC, but they haven't yet proven that they can sell outside their own borders to any real degree.

I view the BEV industry the same way. It's going to come down to who can actually be or buy a leading battery technology firm. Ultimately today's ICEV manufacturers are all engine experts--for BEVs it's going to be batteries.

Paso wineries! Absolutely love Wild Horse and their fantastic Pinots.

- Joined

- Feb 16, 2012

- Messages

- 4,690

- Reaction score

- 7,166

- Location

- At home, in the brewery in Maryland.

Rented a Ford Flex for a week shortly after they came out. I was very impressed, and actually considered buying one. LOTS of interior space, and handled highway and urban traffic very well. I’ve owned nearly as many Fords as Volvos, including 2 Ford pickups. All solid performers.

Paso wineries! Absolutely love Wild Horse and their fantastic Pinots.

Also, the merge onto the 405. My wife’s cousin is actually a very ‘aware’ operator of mechanical devices, and was paying close attention. He’s an interesting person. An electrical engineer, qualified paramedic who is a volunteer firefighter, a licensed pilot, and worked for a while at Scripps in Monterey where he qualified as an operator on the ALVIN submersible.

The family has some brainiacs. His brother served on nuclear submarines, and his sister was an aero engineer and helped in the development of the Space Shuttle while at RocketDyne. Quite a family.

Indeed. No hurry.wait and see

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 2K

- Poll

- Replies

- 75

- Views

- 6K

- Replies

- 12

- Views

- 2K