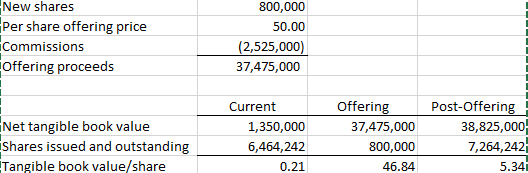

I don't think this means what your post implies it means. Prior to the offering, the company's net tangible book value per share is $0.21. But that's not the economic value of those shares. Most companies (whether public or private) are worth substantially more than their tangible book value per share. All this is saying is that this offering will result in an increased net tangible book value per share (my numbers are a few cents off from the prospectus):

So the offering results in an increase of $5.34 - $0.21, or $5.13 per share in tangible book value. That's what happens when shares are issued at a market price greater than book value. But that doesn't mean that the $50 investment has somehow transformed into only $5.34 of

value. It just means that investors who bought these shares paid more than tangible book value per share, which is completely normal.

[I would never purchase shares in this.]

![Craft A Brew - Safale BE-256 Yeast - Fermentis - Belgian Ale Dry Yeast - For Belgian & Strong Ales - Ingredients for Home Brewing - Beer Making Supplies - [3 Pack]](https://m.media-amazon.com/images/I/51bcKEwQmWL._SL500_.jpg)