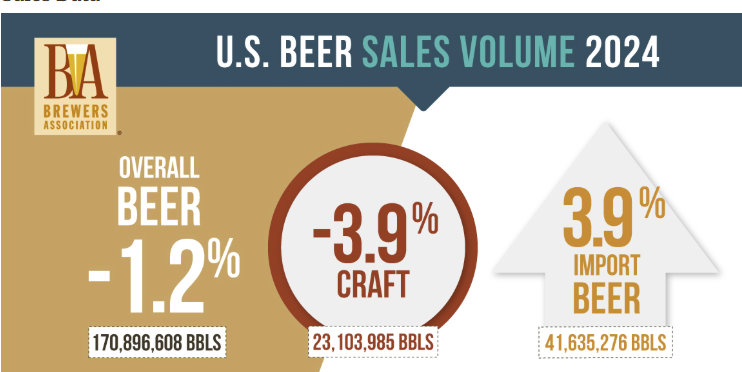

No it's not anecdotal. The same source you cite shows that there a 4% drop on total consumption and that 13% of that is from micros. So that means that people that used to buy from micros just aren't drinking at all, or the macros are increasingly gaining that share.

But you all are right. I should have titled this thread "what no one wants hear".

I'm tempted to stop participating in the dead horse thread but as long as you keep getting this wrong....Craft volume dropped 4%. The 13% number you saw is the craft market share of the total sales.

A 4% drop isn't an apocalypse. I think everyone was so used to unfettered growth that a plateau looks like a free fall.

This is really the important part.

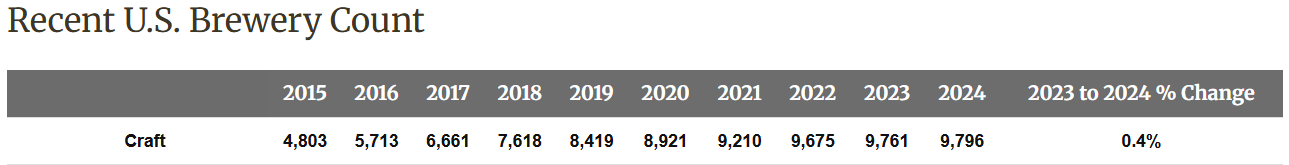

Here's why stuff is optically hitting the fan. Look at the production growth through 2015. It flatlined starting in 2016 and aside from 2020's 12% drop off, it's been mostly flat since then (the average production growth 2016 through 2024 is -1%).

Ok, now slide your eyes over on 2015 to the right. With 42% demand growth logged the year before, we see 41% growth in the number of breweries.

The VERY next year saw flat production but now it was shared by an extra 900 breweries. Look at the average BBLs per year per brewery; a drop from 6495 down to 5100.

You can trace down the right column and see how bleek it got. If in 2014 you were lucky enough to have an AVERAGE share of the market, you'd profit about $6M with would fund that expansion tap room downtown. Just 5 short years later, you'd be making half that.

In other words, craft isn't dying because of what beer they're making or not making. It's just that the number of craft consumers peaked in 2015 but the number of breweries peaked in 2023. The other thing the numbers don't cleanly show is that it only takes a few places to have strong game to steal that average BBL per year away from others. Those are the places closing up. Ah, to be a below average craft brewery in 2015 when you could still profit as if the beer was good.

| Year | Craft Production (bbls) | Growth | Craft Breweries | Growth | BBLs per Brewery |

2010 | 10,133,977 | | 1759 | | |

2011 | 11,467,337 | 13% | 1989 | 13% | 5765 |

2012 | 13,235,917 | 15% | 2347 | 18% | 5640 |

2013 | 15,600,000 | 18% | 2768 | 18% | 5636 |

2014 | 22,200,000 | 42% | 3418 | 23% | 6495 |

2015 | 24,500,000 | 10% | 4803 | 41% | 5101 |

2016 | 24,600,000 | 0% | 5713 | 19% | 4306 |

2017 | 25,400,000 | 3% | 6661 | 17% | 3813 |

2018 | 25,500,000 | 0% | 7618 | 14% | 3347 |

2019 | 26,300,000 | 3% | 8419 | 11% | 3124 |

2020 | 23,100,000 | -12% | 8921 | 6% | 2589 |

2021 | 24,800,000 | 7% | 9210 | 3% | 2693 |

2022 | 24,300,000 | -2% | 9675 | 5% | 2512 |

2023 | 23,400,000 | -4% | 9761 | 1% | 2397 |

2024 | 23,100,000 | -1% | 9796 | 0% | 2358 |

Edit: I just want to clarify that I'm not saying craft isn't on the downward slope of the cycle. We are and the 2025 numbers are probably going to be in the double digits drop if not close. What I AM saying is that the number of brewery closures is much more reflective of out of control supply and any contraction is going to look worse than it is until the number of breweries drops significantly to where good breweries can thrive.

![Craft A Brew - Safale BE-256 Yeast - Fermentis - Belgian Ale Dry Yeast - For Belgian & Strong Ales - Ingredients for Home Brewing - Beer Making Supplies - [3 Pack]](https://m.media-amazon.com/images/I/51bcKEwQmWL._SL500_.jpg)